OG21 Strategy - A New Chapter

Publisert 19. okt. 2021

An efficient innovation system with public stimulation of R&D&I

5.2.1 A sectoral approach to innovation in Norway

The innovation system in Norway follows a sectoral principle where individual ministries govern and coordinate R&D&I investments within their responsibilities, see Figure 44. The "21-processes", such as OG21, support this structure by providing guidance on R&D&I priorities within the sector, often based on a bottom-up approach.

The approach has some obvious benefits, e.g. that R&D&I investments target specific challenges within an industry, and that it is easy to obtain alignment between industry, academia and the ministry on objectives and priorities. The approach has proven efficient to produce results with significant impact as a study commissioned by the RCN on effects of petroleum R&D, clearly indicates (Rystad Energy, 2020).

The sectoral principle also has some weaknesses, as alluded to by OECD in a recent report (OECD, 2021): lack of a high-level agenda setting mechanism; weak holistic coordination; and a fragmented policy landscape. OECD proposes that a mission-oriented innovation policy (MOIP) could address the short-comings and be a supplement to the current system and practices.

Recommendation: OG21 supports the idea of supplementing the well-established and efficient sectoral approach to R&D&I, with cross-sectoral "missions" to guide R&D&I efforts on societal challenges reaching across sectors.

5.2.2 A shared responsibility for R&D&I

The industry, academia and governmental bodies have a shared responsibility for R&D&I. OG21 encourage all R&D stakeholders including industry enterprises, universities, research institutes and public funding bodies, to reflect the OG21 priorities in their R&D&I plans and programs.

OG21 is of the opinion that efficient innovation occurs through collaboration and close connections between many competent stakeholders as depicted in Figure 45. In this picture, public R&D&I bodies play an important role both for bringing stakeholders together and for providing economic risk relief.

5.2.3 Governmental R&D&I support instruments relevant for the petroleum sector

Even though the responsibility for R&D&I is shared between private enterprises, academia and the society, governmental R&D&I incentives and funding are important to adjust for externalities and market failures such as:

- New knowledge and technology resulting from R&D becomes available in the market, which makes it more attractive to be an adopter of new solutions rather than the developer.

- Some technologies may offer high rewards, but struggle to attract R&D investments due to high development costs, high economic risks, or too small application scope within single enterprises' project portfolios.

- Some R&D offer high societal rewards, but do not provide sufficient return to private enterprises.

- System critical research could struggle to attract funding from private enterprises within the industry sector.

A recent study on drivers of transformation in the Norwegian oil and gas industry, focusing on climate-related research, confirms several of the R&D challenges listed above. Based on a survey among participants in the OG21 network, it finds that low profitability and long payback times are among the most important hurdles preventing companies from conducting more climate-related research. Other important hurdles mentioned in the study include lack of regulatory requirements and lack of competence (Karlstad, 2021).

Governmental R&D&I funding is also a possible and important counter-cyclical measure. This was demonstrated in 2016 and 2020 when increased R&D funding contributed to offset parts of the R&D investment decline that followed activity reductions in the Norwegian petroleum sector.

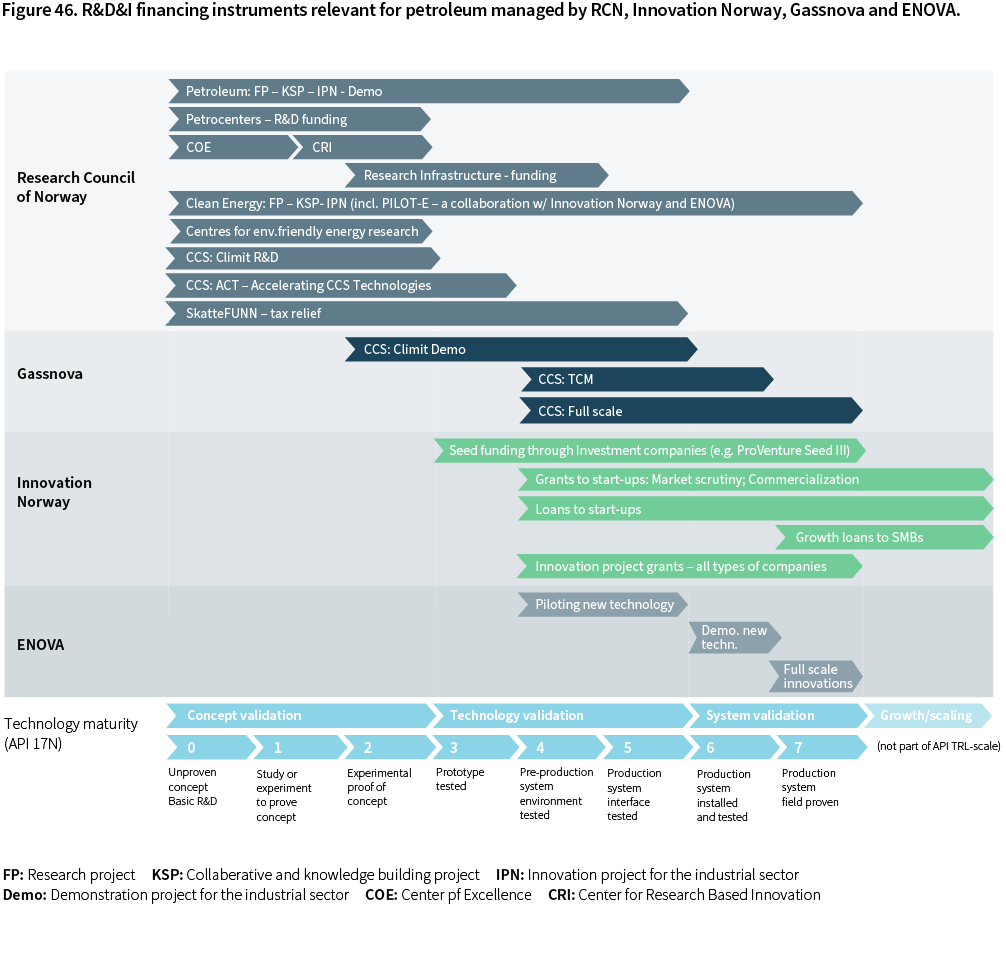

The most important R&D&I instruments managed by governmental R&D&I bodies in Norway, relevant for enterprises and organizations within the petroleum sector, are shown in Figure 46.

OG21 is of the opinion that the Governmental R&D&I financing instruments serve the petroleum industry well, and that they have contributed to creating world leading petroleum clusters. The instruments include:

- The sector specific petroleum R&D program, including FP, KSP, IPN and Demo projects (also known as Petromaks2 and Demo2000).

- Petrocenters, multiple-year funding of research partnerships, which address topics of particular importance for the petroleum industry sector.

- Open R&D arenas where petroleum sector enterprises compete with other industries, e.g. Centers of Excellence, Centers for research based innovations, and Infrastructure.

- SkatteFUNN, an R&D tax deduction program.

- Industry Innovation Norway supported projects, seed funding as well as industry cluster programs.

- ENOVA funding of energy efficiency and climate technology projects.

CCS is a key technology for Norway to reduce CO2-emissions, secure future petroleum markets, and develop new industry. To make CCS attractive, costs need to be reduced and well-functioning value chains need to be established. Climit is an R&D program managed by Gassnova and the Research Council of Norway. It supports technology development within CO2 capture, transport, injection, and storage. Gassnova manages the CO2 capture demonstration project at Technology Center Mongstad (TCM), as well as the full scale "Longship" project with the aim of demonstrating the full CCS value chain from capture to storage.

OG21’s technology priorities are operationalized, among others, through research projects administered by the RCN, see Figure 47. The OG21 strategy provides recommendations and suggested technology priorities to the Ministry of Petroleum and Energy (MPE), which is then reflected in the annual allocation letter from the MPE to the RCN. In 2021, the OG21 scope was extended to also include safety and working environment, which is the responsibility of the Ministry of Labour and Social Affairs. The petroleum portfolio of research projects is the main vehicle in the RCN for operationalization of the OG21 strategy but depending on the type of technologies and knowledge recommended by OG21, the RCN may choose to implement parts of the strategy also in other relevant project portfolios.

The implementation of the OG21 strategy in the RCN project portfolios is monitored through two steps as shown in Figure 48: OG21 reviews relevant portfolio plans, and RCN monitors that the project portfolios reflect the portfolio plans through regular portfolio evaluations.

OG21 believes that the established R&D structure and organization support the close collaboration philosophy. For instance, the RCN petroleum portfolio board has a broad industry representation, and the project evaluation processes and criteria reflect industry needs. The competition for funding and the project selection process results in high quality R&D projects providing high returns for the Norwegian society (Rystad Energy, 2020).

R&D funding from the RCN is allocated through competition. The traditional and well-recognized approach is to issue calls for proposals with set deadlines, evaluate proposals and allocate funding within the budget available to the projects that receive the highest score on evaluation criteria. This linear approach works well for many types of R&D projects where time to impact is not critical. For other projects where time to impact is a determining factor for competitiveness and/or relevance of the results, e.g. digitalization projects within areas with a high transition pace, other approaches that could speed up the innovation cycle should be evaluated. The identification and evaluation of new approaches could be informed by practices used in the industry as well as approaches evaluated or used earlier in the RCN.

Recommendation: The RCN should evaluate new and more agile approaches to R&D funding to complement the established approach and identify for what types of projects and calls such new approaches could be applied. New approaches could for instance be open-ended calls (no proposal deadlines) or parallel funding of competing projects/concepts up to a selection gate after which only the better project(s) receive funding.

Recommendation: To better understand the value of new technologies and how technologies depend on system integration, petroleum research programs should encourage holistic R&D approaches, including system perspectives.

Recommendation: Collaboration across disciplines such as engineering, physics, and social science spur innovation. OG21 encourages cross-discipline R&D collaboration when relevant.

5.2.4 Significant investments in energy R&D

NIFU biannually collects and publish data on R&D investments in Norway split on sectors and types of enterprises, see Figure 49. Petroleum R&D investments are the largest followed by energy efficiency, renewable energy, and CCS. Petroleum R&D has seen a small decline from 2017 to 2019, whereas R&D investments in the other sectors have increased. (NIFU, 2021).

A much larger portion of the total R&D is funded by the industry in the petroleum sector as compared to the renewable energy sector and within the CCS theme. An important driver for the industry to invest in petroleum R&D is the FOT agreement, a mechanism that allows the operating oil companies to charge their partners in production licenses for R&D expenses, given that the R&D is relevant for the NCS, see details in section 5.2.5.

As discussed in Section 3, the future competitiveness of the NCS is dependent upon the ability to reduce GHG emissions from the production, as well as through the value chain for natural gas. In such a context, integration of the petroleum systems with renewables to provide green power to the production, and applying CCS to de-carbonize natural gas, are both highly relevant for the NCS.

5.2.5 Petroleum R&D funding and prioritizations

The Research and Technology arrangement ("FOT-ordningen") is possibly the most important national mechanism for stimulating petroleum R&D. It allows production license operators to charge the production licenses, and thus their license partners, a certain %-age of the licenses' revenue for R&D. The R&D needs to be relevant for the NCS, but there is no requirement of relevance to the specific licenses that are being charged and there is no requirement for disclosure to the license partners of what the R&D funding has been invested in.

NCS operating companies reported nearly 4 billion NOK R&D investments in 2019, see Figure 50. It decreased to 3.4 billion NOK in 2020, probably due to R&D investment cuts resulting from the Covid-19 pandemic. 77% of R&D investments, or 2.6 billion NOK, reported to the RCN in 2020 was charged to the licenses. 23%, or 0.7 billion NOK, was not charged to the licenses, which indicate that some NCS operating companies invest significantly more in R&D than the limits for what the companies can charge their partners. On the other hand, the potential limit for what operators could have charged their partners, aggregated over all licenses, amounts to 3.5 billion NOK in 2020 as compared to the 2.6 billion NOK that was charged. This indicates that some operating companies do not leverage the full R&D potential that the license arrangement offers. The gap could be explained by a lack of organizational capability to initiate, conduct, and follow up R&D projects. It does, nevertheless, represent a lost innovation opportunity for operating companies and the society.

60% of the operating companies R&D investments reported through the FOT-reporting, are done externally in the R&D market. The external investments in Norway, corresponding to 1,5 billion NOK in 2020, are very important for activities and competence development in research organizations such as research institutes.

The R&D investments are well spread on themes aligned with the scope of the various OG21 technology groups. Subsurface, including exploration, reservoir, and enhanced recovery, is the larger one, but all themes see significant investments.

The public R&D investments through the Research Council of Norway (RCN) totaled 630 million NOK in 2020, distributed on disciplines as shown in Figure 52. Investments earmarked for petroleum contributed with 62% of the total. It included investments through petroleum programs such as Petromaks2, Demo2000 and the Petrocenters. "Other" are the open investment programs and schemes where applicants from all sectors compete for funding, e.g. through calls for new research centers and calls for research infrastructure projects. The large portion of "other" shows that petroleum related organizations are relatively successful in the competition for funding through the open arenas, which suggests that they deliver high quality and convincing project applications.

The petroleum R&D funding through the RCN is targeted at suppliers, research institutes and universities. Oil companies are encouraged to participate as research project partners, but they cannot apply for research funding themselves in the petroleum R&D project calls.

Moving forward, public R&D inc entives and funding in Norway are as important as ever to adjust for externalities and market failures discussed in Section 5.2.3.

entives and funding in Norway are as important as ever to adjust for externalities and market failures discussed in Section 5.2.3.

- Reducing GHG emissions will be crucial to attract project investments, maintain society acceptance and curb global warming. Even with increasing CO2-costs as described in the Government white paper on climate strategies (Meld.St.13 (2020-2021)), technology for reducing GHG emissions offers low economical returns, at least on the enterprise level.

- The NCS is maturing, and the average field size is decreasing. This reduces the financial capability of individual licenses to carry R&D investments.

- Improved oil recovery is important for a maturing NCS, but often such projects are marginal and new IOR/EOR technologies could struggle in the competition for funding internally in oil companies.

- The NCS attracts new types of oil companies, often smaller with a strategy of applying market proven, low risk technologies, and with little appetite for developing and applying new technologies.

- Petroleum from the NCS is competing with supplies from other regions in the world. Staying competitive requires improved productivity and lower cost solutions.

- The global competition for attracting technology clusters is increasing.

A report commissioned by the RCN, shows that petroleum research creates high value for the society, and that research can also contribute to solutions that help Norway achieve its climate commitments. The report estimates that for every NOK the Norwegian society invests in petroleum R&D, it gets a 30-fold payback, (Rystad Energy, 2020).

Public petroleum R&D funding contributes to realize value through development of competence and solutions in academia and research institutes and by stimulating industry R&D and innovation. Figure 53 and Figure 54 illustrate that many more high-quality R&D projects could have been conducted if more public funding had been available. The graphs show the accumulated Petromaks2 and Demo2000 awards split on the project evaluation scores where 7 is the highest. If all high-quality projects (grade 5 or higher) should have received funding, the allocations would have had to almost double for Demo2000 and increase three-fold for Petromaks2.

Recommendation: OG21 recommends that public funding through Petromaks2 and Demo2000 is increased. Historic data suggest that there is sufficient research capacity and high-quality R&D project ideas to accommodate a significant increase of the annual budgets.

5.2.6 Opportunities within the EU research and innovation system

EU will over the years 2021-2027 invest a total of 95 billion € in R&I through the Horizon Europe program. It is organized into three pillars as shown in Figure 55. The "Excellent Science" pillar covers basic research, whereas Pillar II on "Global Challenges and European Industrial Competitiveness" is centered around applied research with the potential for fast adoption of results. "Climate, Energy and Mobility" is one out of 6 clusters organized under Pillar II of the program. Approximately 28% of the pillar's budget, or more than 15 billion €, is allocated to this cluster.

The energy scope of Horizon Europe is aimed at de-carbonizing the energy system to meet EU's target of climate neutrality by year 2050. It includes energy topics such as renewable energy, CCUS and energy systems, power grids and energy storage. Petroleum is not included – nevertheless Horizon Europe provides enterprises and institutions that historically have operated within the petroleum industry and that now want to make the transfer into low-carbon energy industries, opportunities for R&I support.

Successful applicants for EU R&I funding are characterized by:

- Project proposals that demonstrate R&I excellence and solutions with high impact and job creation in Europe.

- This must be achieved through strong partnerships that combined can muster the competence and skills to cover the complex challenges of the calls.

- A strong understanding of EU's R&I objectives, and a convincing demonstration of the partnership's capability of contributing with tangible results and impacts.

There are several R&I priorities specifically mentioned within the cluster "Climate, Energy and Mobility", that align well with the competencies and capabilities of many Norway based enterprises and institutions that historically have worked for the petroleum industry, e.g.:

- Earth system science.

- Global leadership in renewable energy, e.g. geothermal and offshore energy production.

- Energy systems, power grids and energy storage.

- Carbon capture, utilization and storage.

There could also be many opportunities within other clusters, e.g. in Cluster 4, "Digital, industry and space", where for instance advanced materials, AI and other data analytics, and robotics are included.

In addition to Horizon Europe, other EU initiatives where Norway participates, also provide R&I opportunities:

The EU Important projects of common European interest (IPCEI) address specific strategic topics such as batteries and hydrogen. Norway is co-funding the hydrogen IPCEI and Enova manages the Norwegian participation. The selection of Norwegian projects for further matchmaking with projects from other countries was done in March 2021. Innovation Norway has the responsibility for coordinating future IPCEIs.

An EU Clean energy transition partnership (CETP) is being developed. Norway will be participating through the RCN, and calls are likely to include topics such as CCUS, renewable energy and energy systems.

EU is setting up 10 new European partnerships where industry clusters and the EU collaborate for a green and digital transition. Relevant partnerships for Norwegian industry include "Key digital technologies" and "Clean hydrogen".

The EU Innovation fund is funded with revenue from the European Trading System (ETS). It funds the commercial demonstration of new low-carbon technologies such as CCUS, renewable energy and energy storage solutions. Innovation Norway manages the Norwegian participation.

Norway also participates in the Digital Europe Programme. The program will provide strategic funding to projects in five key areas: in supercomputing, artificial intelligence, cybersecurity, advanced digital skills, and ensuring a wide use of digital technologies across the economy and society, including through Digital Innovation Hubs.

Further information on the Horizon Europe and other opportunities for Norwegian organizations in the EU R&I system, can be obtained from National Contact Persons in the Research Council of Norway and Innovation Norway: https://www.forskningsradet.no/eus-rammeprogram/horisont-europa/ncp/and https://www.innovasjonnorge.no/no/tjenester/snakk-med-en-radgiver/eu-finansiering/ .

5.2.7 International collaboration on R&D

Since petroleum R&D is not part of the Horizon Europe scope, the Norwegian national petroleum research programs as well as research collaboration efforts between Norway and other countries with petroleum production, become particularly important for the petroleum industry.

Norway currently has bilateral agreements on petroleum research, technology development and higher education with among others the USA and Brazil. Further collaboration agreements should be evaluated based on the strategic R&D priorities for the Norwegian petroleum industry described in this OG21 strategy.

Meldinger ved utskriftstidspunkt 19. april 2025, kl. 11.44 CEST